Unknown Facts About Hiring Accountants

Table of ContentsUnknown Facts About Hiring AccountantsThe Ultimate Guide To Hiring AccountantsNot known Details About Hiring Accountants Our Hiring Accountants DiariesSome Ideas on Hiring Accountants You Need To KnowThings about Hiring Accountants8 Easy Facts About Hiring Accountants Explained

Not just do you require to make sure that your employees are paid promptly, however you additionally need to withhold the correct amount of tax obligations and other reductions. This can be a daunting job, especially if you're not familiar with pay-roll laws and policies. This is an additional area where an accounting professional can be beneficial.An accounting professional can likewise aid you track staff member holidays and sick days. As a result, hiring an accountant to handle your pay-roll can conserve you time and anxiety.

The smart Trick of Hiring Accountants That Nobody is Talking About

A seasoned accountant can assist you stay clear of expensive errors that could destroy your organization funds. An accountant can help you avoid these mistakes and keep your business funds on track.

This is where hiring an accountant can be valuable. An accounting professional can help you remain arranged and in control of your financial scenario.

This is where an accountant can be an important asset. By entrusting your monetary documents to a professional, you can free up your time to focus on various other facets of your company.

The 9-Minute Rule for Hiring Accountants

Numerous Canadian service owners whine regarding the quantity of taxes they pay each year, which is understandable. Businesses obtain strained harder than many taxpayers.

What business does not require this? A certified accounting professional will certainly assist you classify both incoming and outgoing items to reduce complication and maintain things in order.

The duty of the certified accountant, in this case, is to help you acquire or acquire a system that will be best for your particular service - Hiring Accountants. Some organizations have actually had a system making use of nothing but journals for the whole life of their company and it works. A qualified accounting professional will certainly have the ability to tell you quickly if your current audit system will certainly function or otherwise

Right here is a hard, cold reality: Many local business owner, particularly if they're start-ups, recognize little or absolutely nothing regarding the ins and outs of tax obligation preparation or compliance. Functional accountancy qualified accountant can be vital at this time in obtaining things right. A certified accounting professional has to keep update with tax obligation legislations annually.

Our Hiring Accountants PDFs

On the internet systems may end up being overwhelmed and unable of handling elaborate financial scenarios, leading to costly mistakes over time. A professional accounting professional will certainly have a strong understanding of the tax implications that are related to your company's financial activity. They will think about all your monetary objectives and give individual focus to lessen tax obligations and stay clear of a potential internal revenue service audit.

An additional useful benefit of employing an accounting professional is the opportunity for face-to-face communications. Constructing a professional partnership with your accounting professional establishes count on, credibility, and clear interaction.

An accountant's attention to information assists you identify and remedy any type of errors prior to sending tax obligation records, avoiding pricey, impactful errors. Accounting professionals will increase and three-way check your documents to guarantee they are certified with the most up to date tax obligation regulations. In the digital age, choosing between on-line systems and specialist accounting professionals for tax filing exceeds benefit.

While on-line platforms may provide speed and ease, they lack human communication and a personalized technique to tax declaring. If you select to use an online system, consider using an accountant. They can supply you tips and methods to browse the platform. Generally, there is tranquility of mind that comes with understanding your taxes remain in the hands of an expert and it will certainly be an investment that repays past the April deadline.

Little Known Facts About Hiring Accountants.

Tax season can really feel overwhelming for great deals of individuals and services. Comprehending all the challenging tax obligation rules, making certain every little thing complies with the law, and obtaining one of the most out of your returns are hard tasks. They require a person who recognizes their stuff and pays attention to every information. Employing a tax accounting professional in Royal prince George is the very best means to stay clear of pricey blunders such as failing to upgrade the social safety and security details, forgetting to document the reductions, etc.

Also, having an accounting professional ensures that they will certainly recognize the most current legislation and policy that aids them to end up the task prior to the deadline. Employing a tax obligation consultant in Prince George helps to keep you on check over here track with all your settlements, bookkeeping, financial development and overhead.

Have you dug much deeper to think about what your typical everyday might look like as an accountant? We have actually placed together a listing of accountancy pros and disadvantages to assist you figure out how the job could fit with your individuality, functioning style and life priorities.

There's a great deal to like regarding a click here to find out more job in bookkeeping. If you're studying audit, you're learning distinct functional abilities companies need for a certain set of duties.

Everything about Hiring Accountants

Practically every company needs an accountant or the services of an external bookkeeping firm, and even the average person has factors to work with an accountant from time to time. As long as organizations exist and people need help with tax obligations, there will certainly be a need for accounting professionals.

If that lines up with your career objectives, it can be a significant upside of an accountancy profession. Just like any kind of market, operating in accounting click here now might have its drawbacks. Right here are a few of the much less enticing components of an accountancy job. Hopefully, seeing where you land can help you determine whether it's the ideal fit.

All about Hiring Accountants

In this feeling, accounting careers use some range in the yearly routine. When you're liable for an organization's funds, there is bound to be some stress.

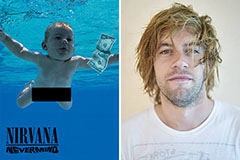

Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!